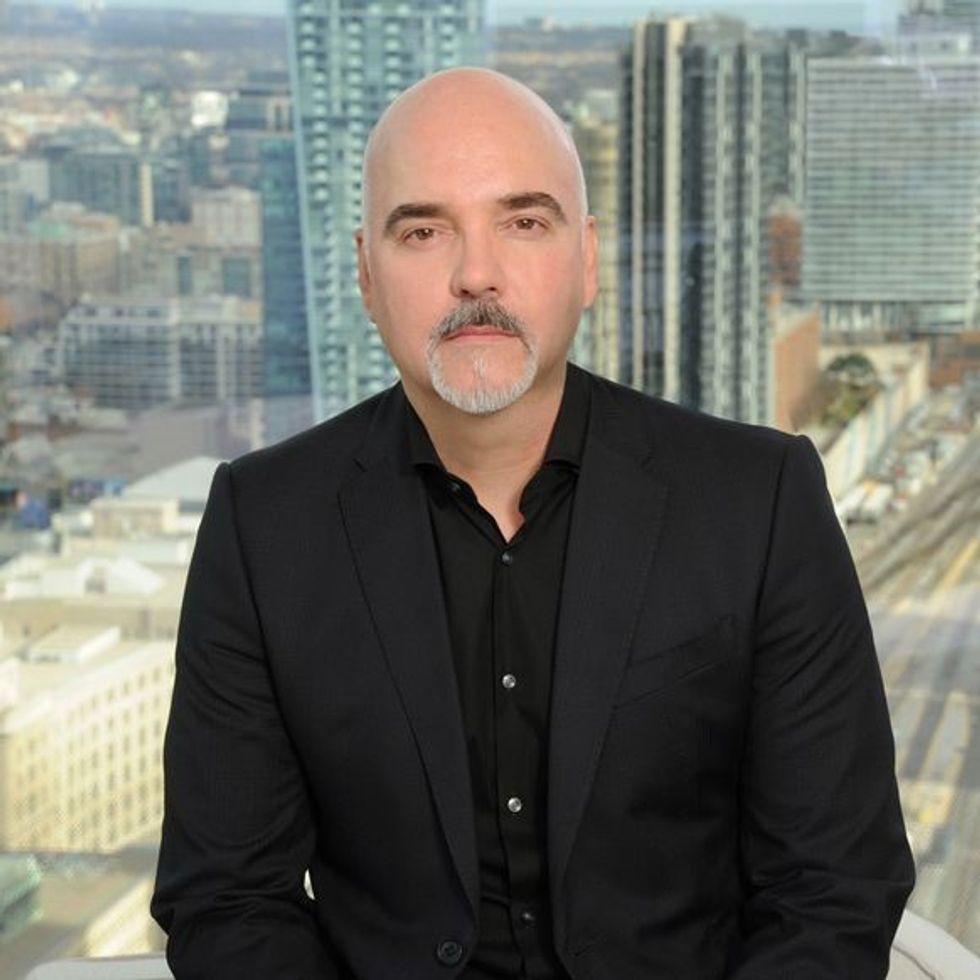

He's Back! Robert Ott Has Big Plans For His RJO Enterprise

He built a music empire that generated wealth for investors and creators alike, and after taking an extended holiday, he is back to do it his way all over again with a new enterprise, a book, and even a music festival.

By Martin Melhuish

Robert Ott, founder and former CEO/Chairman of ole (recently rebranded as Anthem Entertainment), one of the world’s largest independent music publishing, recorded music and rights management companies, stepped down from those duties in late 2018 after selling his stake in the company. He has since founded RJO Enterprises, a private investment company based in Toronto. In this candid chat with Martin Melhuish, Ott briefly looks back on the ole years, which saw a small-town kid found and build a successful multi-national music company for which he raised almost $1 billion over time. He also talks about future plans that now also include a music festival in the Okanagan Valley and a book that shares real-life, hard-learned lessons about the entrepreneurial journey with beginning and mid-stage entrepreneurs.

What were the circumstances surrounding your departure from ole?

With any large-scale investment, like the one in ole, there are a couple of goals involved. One of them is to build a great company, but with that comes the eventuality that at some point that company will be transacted. When you’re working with an institutional investor like the Ontario Teachers’ Pension Plan, that potential is always on the table. At a certain point, it just made sense to take a look at the value of the company and, as I’m sure you are aware, there was a public process around that, and there was going to be an outcome. Eventually, Teachers’ offered to buy my stake, and it seemed like good timing and the right move for me, so I took the offer.

You started ole in the early 2000s during a disruptive period for the music business. What was your philosophy at the time in raising capital for the company?

At the time, a lot of parties on Bay Street in the financial sector were looking for ways to diversify out of holding a predominate amount of their capital in the stock market; they were looking for defensive strategies against market fluctuations. The whole field of private equity was in a fledgling state at the time. I began to have conversations with people from the financial sector who were interested in the annuity-like nature of music publishing rights and revenue streams. At the time I was at the helm of BMG Music Publishing in Canada, and we began having conversations with some of the financial people about how the revenue streams work, and it soon became obvious that it was a good fit. One of the hurdles I had to overcome was thinking big enough in terms of scale that these folks play in. We eventually did get the company funded, which was about $40 million at the time.

ole evolved over the years from a music publisher to a company with wider interests. Just in a thumbnail, how did that evolutionary process play out?

The company’s initial core was music publishing, but, over time, it made sense to branch into other avenues where we could use a common back office to create economies of scale. The more diversified we were, the more opportunity we had to be defensive against being disintermediated by our competitors. It also gave us the chance to scale in multiple areas.

Achieving scale and having the ability to grow in different directions was an intention from the outset and a desired outcome for any institutional investor. We ended up getting into the label business with the acquisition of Anthem Entertainment. We grew into a serious multi-channel network business and embraced neighbouring rights, AV secondary rights, and production music. These businesses were diverse, yet associated, so we didn’t have silos sitting too far away from the core business. They all made sense, were cohesive, and used a common back office.

In the fall of 2016, you arranged a USD 500 million credit facility from a consortium of 12 U.S. and Canadian banks to fund acquisitions. A year later it was reported that the company had a gross margin of around $65M and EBITDA of 60 percent. What do you consider are some of the other major highlights of your tenure as CEO/Chairman of ole?

Initially, we were very focused on the film and television space. It was the road less traveled in the publishing world at the time and defensive against the downturn in mainstream music due to P2P file sharing. You have to remember, we came into the market up against many mature multinational companies and needed to find our own niche.

The first deal that we struck was an administration deal in 2005 with Corus Entertainment for the Nelvana music publishing rights, which later turned into 15 some-odd deals and with us progressively doing more business in partnership together. That was the deal that put the bedrock in the company and led to many other deals in film and television. By the time I exited the company, we had done 80 to 90 separate publishing deals with major AV content producers. Our audio-visual secondary rights business had some 700-plus clients around the world, including companies like Dreamworks, ITV and the BBC. AV music was an intentional strategy and led to the Sony Pictures acquisition in 2013. That was a watershed moment. It had an incredible lifting effect on our EBITDA, which basically doubled overnight. It was a decisive moment for the use of leverage in the company because we were able to finally part ways from our cost structure and become very profitable. That led to more acquisitions in the mainstream music space like Timbaland and Rush. At that point, we had a real company.

What is your perspective now on that period of your professional life?

In 2001, the late Tim Laing and I began planning ole (ott-laing enterprises). The official launch came in late 2004. I’m very proud that, over 14 years, we were able to fund to nearly $1 billion and build one of the most successful, multi-national music companies in the world. The team we built there was smart, innovative and came together as an incomparable, entrepreneurial culture that elevated creators. During that era, we were honoured that Ray Danniels and Rush allowed us to acquire and cultivate the Anthem legacy. I look forward to seeing the new CEO’s future contributions and wish her success in her new role.

After almost a decade and a half of the daily business and responsibilities that go with running a company the size of ole, besides a more restful routine in the short term, what are your plans for the future?

During the time that I was at the company, I always signed my e-mails with my initials “RJO.” I had a company, RJO Enterprises, which was the holding company for my shares in the ole corporation that I eventually sold. I’ve recreated RJO Enterprises into a home office private fund that invests private capital and is looking at acquiring assets, not only in the IP and music space but also in the technology sector. During my tenure at ole, I took a keen interest in technology and invented a business analytics and intelligence software system that analyzed and conformed royalty data globally while automating much of the royalty processing. That software was a big reason that our overhead and margins were so strong. RJO Enterprises is also answering a need in the market for intellectual property buy-side, consulting, and external M&A capability. Today, many institutional investors are interested in the IP space, as are corporations that are perhaps in a more service-oriented business where they look across the aisle and think, “Content is king,” and it certainly is.

When you are in an industry that owns relationships more than it owns things like a property or an asset, it’s obviously attractive to hedge against that with actual ownership of intellectual property. Having done 500-plus IP deals during my tenure at ole, including going-concern deals, these transactions are something that I’m very familiar with and expert at. The phone has been ringing with interest in that, and it’s a pretty natural segue for me.

One of the things that RJO Enterprises has invested in is a music festival in the Okanagan Valley in British Columbia called 97 South Song Sessions. (97southsongsessions.com) It’s meant to be a cultural experience that complements the wine-making and culinary experience that’s growing in that region of the Okanagan. I’ve seen that international wine-touring publications are starting to feature the Okanagan Valley as a global wine destination. It’s really great to see. My wife Robin and I have been home owners in the area since 2011, and we’re excited to support this event which runs this year in Penticton/Naramata Bench and features some great international songwriting talent: Tim Nichols, Jimmy Yeary, Jessica Mitchell, and Bob DiPiero. It’s slated to have a much bigger presence next year and encompass the entire area.

I’m also working on a book titled Mission Possible: The Entrepreneurial Journey. It isn’t autobiographical, though it will certainly feature anecdotes about my career and my progression through the music business, from the age of 18 when it was all a dream and it was all in front of me, to building the company (ole), right through the process of moving on to my second act. The book is really about the emotional and mindset journey that an entrepreneur goes through, no matter what business they decide to embark on. There’s the inevitable nay-saying and self-doubt that inhabits, and inhibits, that kind of endeavour, and how one overcomes those factors to have the courage to build a company from scratch is consequential. It’s subject matter that I’m uniquely able to relate to given that, when I started in the business, I didn’t really know anyone in the music business. I had no real idea of how to go about any of what I accomplished, so it was a process of figuring it out one step at a time. There were a lot of moments along the way where I had doubts about whether I would have any success. I feel if I can pay forward some of the learning experiences that I had over those years, and help early or mid-stage entrepreneurs find the path forward, I will have accomplished what I set out to do. I’m also a contributor to a book coming out of the U.S. titled Don’t Quit: Stories of Persistence, Courage and Faith, which mines the same ground.

Looking back, are there any special memories from your pre-success, early days in the music business?

At 19, I had started this little music publishing company called Lunar Music, signed a couple of songwriters and dreamed about having a song on the radio. I made up posters that were a take-off on the American marine poster but instead of a soldier saying, “We’re looking for a few good men,” it was a soldier with a guitar saying, “We’re looking for a few good songs.” I put these up in live venue green rooms around Hamilton and eventually got them distributed through Sam the Record Man across Canada. One of the people who saw the poster was Dave Rave (Teenage Head), and he eventually came up to my studio to find out what it was all about. He subsequently invited me to New York to see how they did things in the big leagues. While down there, we went to the New Music Seminar (NMS) and, by happenstance, I ended up in the middle of the riot at the host hotel, documented in the film Straight Outta Compton. It completely redefined the New York minute, which was roughly twice the time it took me to get off that floor of the hotel when the guns came out. First time I’d ever seen people use guns indoors. Looking back, that could have been the beginning and the end of my career in music. To come from those humble beginnings and look back on what has transpired, I can say that this has been an incredible journey, and more than I ever expected.

-- Robert Ott can be contacted at info@rjoenterprises.com